The following commentary is co-authored by Curtis S. Chin, former U.S. ambassador to the Asian Development Bank and inaugural Asia Fellow of the Milken Institute, and Abhinav Seetharaman, a graduate student at Harvard Kennedy School and former Princeton-Asia-Fellow at the Milken Institute in Singapore.

The conclusion of the World Bank Group and International Monetary Fund (IMF) spring meetings in April left behind an elephant in the room.

Since the cancellation of the World Bank's "Ease of Doing Business" Index and report late last year, the World Bank has so far failed to adequately replace what had been a landmark and — while far from perfect — very useful tool to drive change.

The annual report had assessed and ranked countries' relative ease of doing business since 2003. It was used by a range of entities — public, private and not-for-profit — to track and encourage improvements in the business climate.

That ended last year.

In September 2021, an independent investigation by the law firm WilmerHale found that top World Bank leaders might have manipulated data and placed undue pressure on staffers to inflate rankings and scores for China, Saudi Arabia, and other select countries.

It might well take significant time and effort for the World Bank to rebuild trust and to fundamentally reform. Skeptics abound.

Among the leaders spotlighted were then-World Bank CEO Kristalina Georgieva (now managing director of the IMF) and then-World Bank president Jim Yong Kim, both of whom allegedly pressured employees to help secure support from China for a capital increase for the bank. The investigative report detailed that the World Bank's Doing Business team eventually increased China's ranking by seven spots from 85 to 78.

Georgieva said last year that she disagrees "fundamentally" with the WilmerHale findings.

[Ed. note: The IMF had no comment, but the fund is undertaking a review to strengthen its institutional safeguards. Kim was not immediately available to respond to a CNBC request for comment.]

After the WilmerHale probe into China's possible behind-the-scenes intervention, the World Bank announced the immediate discontinuation of its Doing Business series.

The inconvenient truth remains that the cessation of the report after findings of data irregularities and ethical concerns in the 2018 and 2020 reports only underscores how the World Bank and other multilateral bodies remain in need of reforms. The abrupt end of the report — a case of throwing the baby out with the bathwater — was a disservice to those who valued and used the index and accompanying data.

Behind-the-scenes interventions and undue pressure continue to interfere with the valuable role that multilateral financial institutions can play in encouraging nations to create a better environment for business and channel the power of private capital to uplift the most vulnerable communities.

From now on, it would be beneficial to see a more transparent and reformed World Bank Doing Business Index used as a benchmark for necessary changes in areas ranging from electricity access to bankruptcy laws to regulatory enforcement.

Long seen by many as a means of helping countries improve their business climates, the index has admittedly not been without controversy. Poorly ranked countries have often questioned findings and methodology, despite the World Bank repeatedly holding its ground in support of its staff and the report's impact.

3 steps for the World Bank to rebuild trust

The decision to end the report should be revisited and reversed. Instead of terminating the report, the World Bank should re-commit to building back trust and producing public pieces of high quality, with impact and integrity.

Such an effort would require three key steps.

First, the World Bank and other leading multilateral development banks institutions must rectify longstanding issues, starting with introspection and better assessment of past work. Whose interests are being served? How thorough is the analysis? Are the findings fully impartial? Addressing such questions openly and transparently is essential to ensuring accountability.

Second, institutions must recommit to the value of third-party data collection and truly independent evaluation and assessments. Accurately informing and educating through the delivery of reports also will require management and staff who will not succumb to external pressures from countries seeking to undercut or replace existing Bretton Woods institutions.

And third, the staff and leadership of the multilateral development banks and other international financial institutions — as well as the boards of directors that guide them — must embrace informed engagement and partnership with the private sector globally.

Why 'Doing Business' matters

As emerging and developing economies struggle to fight poverty in this time of pandemic and war, the value of business and private capital is more important than ever. The private sector's contributions to international development will only grow in importance as inflation and exchange rate volatility continue to hamper many government-led efforts.

Last November, the World Bank announced plans to replace its Doing Business report circa late-2023. Those include a mandate for increased transparency about methodologies, more incorporation of survey data from companies, and reduced emphasis on numerical rankings.

Other reforms can also yield positive results. Reshaping internal governance structures within all the multilateral development banks can help prevent staff members from executing inappropriate data changes that help select countries.

Properly codifying policies on how such complex situations are to be handled also can significantly reduce the risk of data manipulation. Concerns about conflicts of interest must also be addressed.

And establishing more sophisticated support systems can enable employees to challenge questionable orders from superiors while preserving their job security.

Don't reward data manipulation

One of the unfortunate consequences of what has happened is that countries that had consistently performed poorly on the Doing Business report and welcomed the end to the report may now feel less pressure to change — to the detriment of poverty reduction efforts. Wrongful data manipulation should never be rewarded.

Our experience in Asia, including service on the board of the Asian Development Bank, is that the Doing Business index and report had indeed, as envisioned, created a range of positive outcomes. Countries, small and large, had taken the rankings into account and worked toward improving their standings.

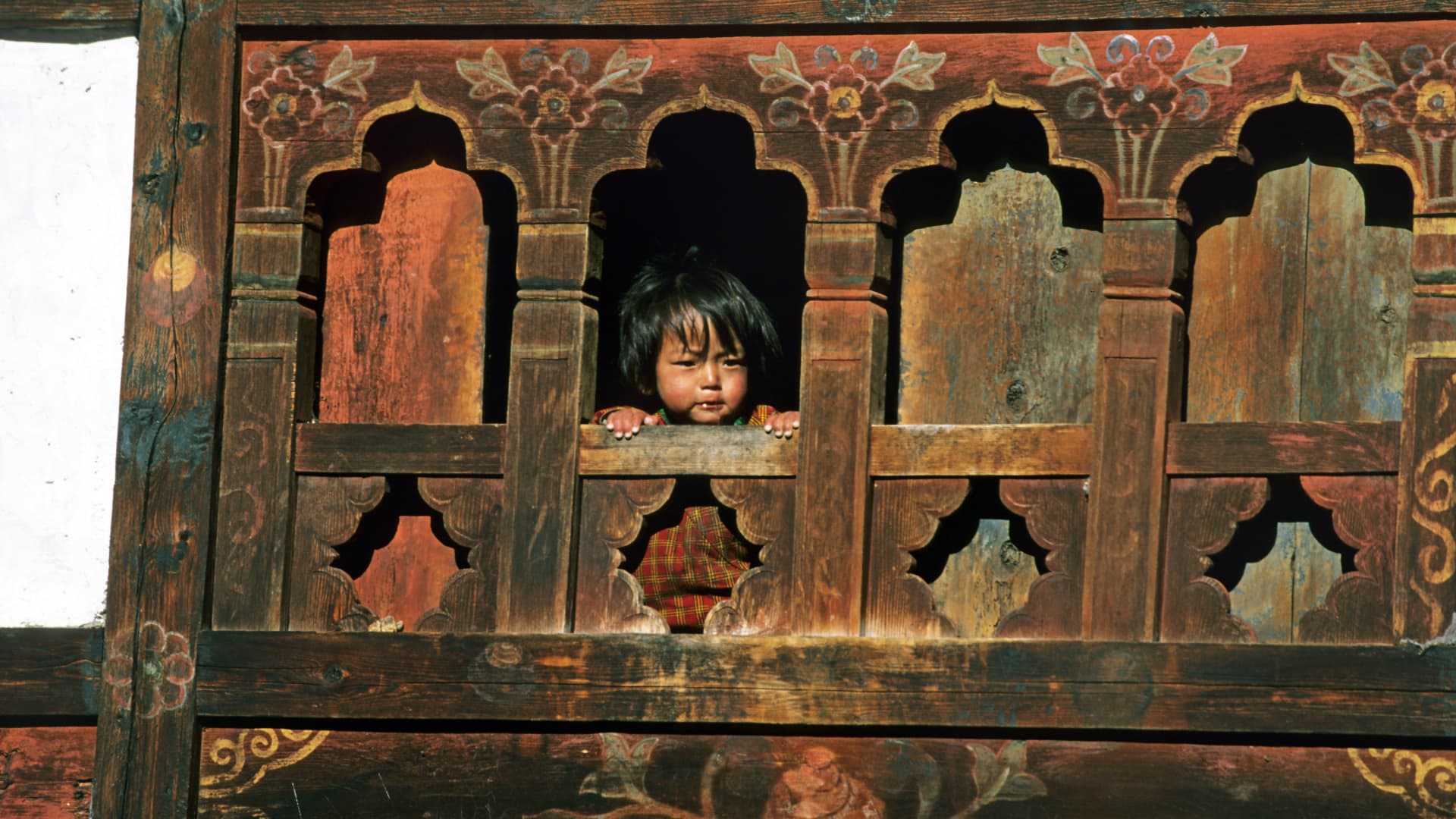

For example, the small South Asian nation of Bhutan had made a public commitment to address the report's findings and move up in the rankings. Concrete steps were taken and indeed, over time, the nation's ranking improved.

One of Southeast Asia's largest economies, Thailand, has viewed the report as a critical way of enhancing its competitiveness in Asia-Pacific.

And in 2020, four ambassadors including then-U.S. ambassador to Thailand, Michael DeSombre, built on the assessments of the World Bank and others to prescribe a 10-step approach for Thailand to improve its domestic business environment and secure a quicker and more sustainable growth path.

It might well take significant time and effort for the World Bank to rebuild trust and make fundamental reforms. Skeptics abound.

The time to act with purpose is now. A return of the Doing Business Report and Index will be a good first step.

[Ed. note: The World Bank declined to comment for this article but directed CNBC to its "Business Enabling Environment" project, which is under development.]

"world" - Google News

May 03, 2022 at 08:39AM

https://ift.tt/pyU37dm

Op-ed: It's time for the World Bank to get back to the business of doing business - CNBC

"world" - Google News

https://ift.tt/sbdj6Vq

https://ift.tt/TKREWgk

Bagikan Berita Ini

0 Response to "Op-ed: It's time for the World Bank to get back to the business of doing business - CNBC"

Post a Comment