Orion Advisor Solutions CIO Rusty Vanneman discusses his top ETF sector picks if the U.S. dollar continues to weaken.

The almighty U.S. dollar may have reached the pinnacle of its strength, but it's unlikely to cede its status as the world’s reserve currency.

Continue Reading Below

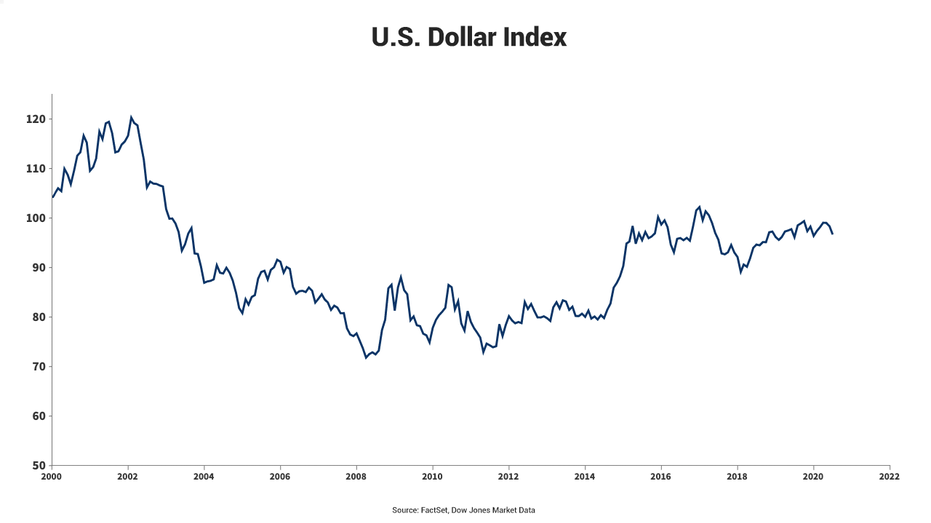

While safe-haven buying propelled the U.S. dollar index to a nearly 17-year high of 102.82 on March 20 -- amid fears the COVID-19 pandemic would bring the global economy to its knees -- the index had pulled back to 97.09 at Friday's close as panic safe-haven buying dissipated.

The index, which measures the greenback's value against a basket of world currencies, has a 57.6 percent weighting towards the euro while the Japanese yen, British pound and Canadian dollar combined make up almost 35 percent.

STOCKS RAVAGED BY CORONAVIRUS BENEFITING FROM MARKET 'MANIA'

“The dollar has topped,” Marc Chandler, chief market strategist at the capital markets trading firm Bannockburn Global Forex, told FOX Business.

“Central banks and the government are pumping up tons of money and that money is encouraging people to buy risk assets,” he added. “And so I think that the dollar suffers with that.”

That liquidity has given a booster shot to a U.S. economy that entered its sharpest slowdown of the postwar era after stay-at-home orders aimed at slowing the spread of COVID-19 forced nonessential businesses to shutter their doors during the second half of March.

The lockdown cost 44 million Americans their jobs, at least temporarily, and caused a 5 percent contraction in annualized first-quarter gross domestic product that Wall Street economists expect will deepen to at least 30 percent in the three months through June.

As the economy recovers from the lockdowns and money flows into riskier assets, Chandler sees the U.S. dollar falling below 1.15 per euro from 1.10. That will push the U.S. dollar index to 92.50 this year, he said.

Strategists at Bank of America, however, say the U.S. dollar's weakness has already run its course and that the greenback is going higher from here.

“We remain positive on the U.S. dollar, expecting weak economic recovery and seeing risks of higher Covid-19 infections" as shelter-in-place orders expire and people return to their routines, wrote Athanasios Vamvakidis, a London-based foreign exchange strategist at the bank.

Vamvakidis’ colleague Michalis Rousakis, a London-based G10 currency-exchange strategist, sees the dollar strengthening to 1.02 per euro in the second quarter before weakening to 1.05 by yearend. Then there’s Stephen Roach, senior lecturer at Yale School of Management and former chairman of Morgan Stanley Asia, who earlier this week penned a Bloomberg op-ed in which he said U.S. living standards, which have been “stressed” by the COVID-19 pandemic, are about to be “squeezed as never before” at a time when the rest of the world is questioning American exceptionalism.

BLOCKBUSTER JOBS RALLY PUTS US ON FAST TRACK TO CORONAVIRUS RECOVERY

As a result, he believes the greenback’s reserve currency status is coming to an end and that a “crash in the dollar could well be in the offing” as the balance shifts.

The U.S. dollar became the world’s reserve currency because of the depth and the breadth of the Treasury market. The currency was backed by the world’s largest gold reserves when it claimed its status at the 1944 Bretton Woods conference.

"These kind of arguments about how ugly the dollar looks, they ring true to me, except for one thing,” Chandler said. “What's the alternative?”

While Roach doesn’t lay out the case for what happens next, Chandler said the Chinese yuan, or renminbi, cannot be the world’s reserve currency. Beijing holds $3 trillion of the world’s $11 trillion of reserves and if it converted those to its own currency, they would no longer be reserves.

Chandler added that neither Hong Kong nor Taiwan, which have saved $500 billion to $600 billion of reserves, are likely to use the renminbi.

Additionally, the German and French bond markets are not “big enough to absorb those flows,” he said. The European bond market is more comparable to the U.S. municipal-bonds market, which has smaller issues coming from varied issuers, such as California and New York City.

Those who are calling for the end of the dollar’s reserve status will be paying close attention to next week’s virtual EU summit, which some are calling a “Hamiltonian moment” as leaders are discussing the creation of a common bond market in Europe that could be the “beginnings of an alternative” to the dollar, Chandler said.

Hamilton, who was the first U.S. Treasury Secretary, allowed the newly established federal government to assume the debts of the colonies, which was a major catalyst in forming the now-dominant system.

Still, the size of the issuance being considered is $500 billion, meaning it would “take years” for the euro to challenge the dollar’s reserve status, he said.

A common bond is by no means a done deal. There are still deep disparities between the creditor nations of Northern Europe and the debtors of Southern Europe.

CLICK HERE TO READ MORE ON FOX BUSINESS

“While everybody’s talking about a Hamiltonian moment, I think what they might need is an Abraham Lincoln,” Chandler said. “There still isn’t a unification there.”

"world" - Google News

June 13, 2020 at 08:30PM

https://ift.tt/3flYtPO

Weakening US dollar still unrivaled as world's reserve currency - Fox Business

"world" - Google News

https://ift.tt/3d80zBJ

https://ift.tt/2WkdbyX

Bagikan Berita Ini

0 Response to "Weakening US dollar still unrivaled as world's reserve currency - Fox Business"

Post a Comment